30+ mortgage reserve requirements

Ad Compare the Best Reverse Mortgage Lenders. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

Cade Ex991 149 Pptx Htm

Web Reserve requirements will vary from bank to bank and from mortgage program to mortgage program but you can get a good idea of what you may need to provide for.

. Equity in other investment real estate owned by the borrower cannot be used for reserves. Web Remember that reserves cannot be gifted or borrowed funds. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

Your mortgage payment is known as PITI principal. Ad Compare the Best Reverse Mortgage Lenders. Web Like conventional mortgages jumbo loans come in a variety of terms and repayment schedules and they can be fixed-rate or adjustable-rate loans.

Discover All The Advantages Of A Reverse Mortgage Loan And Decide If One Is Right For You. Web Reserve Requirement Reserve Requirement Ratio Deposit Amount For example if a bank has received 100000 in deposits and the reserve requirement ratio is set at. Web There isnt a reserve requirement unless you are funding a three- or four-unit property and youre using rental income to qualify.

Web FHA Credit Requirements for 2023 FHA Loan applicants must have a minimum FICO score of 580 to qualify for the low down payment advantage which is currently at 35. Ad Calculate Your Payment with 0 Down. Web How do mortgage reserves work.

Jumbo loans involve more risk for the lender. Conventional loans may require zero. Web Eligibility Matrix also includes credit score minimum reserve requirements in months and maximum debt-to-income ratio requirements for manually underwritten loans.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. For Homeowners Age 61. Web Effective for the reserve maintenance period beginning December 30 1999 the low reserve tranche for net transaction accounts was reduced from 465 million to 443 million.

For Homeowners Age 61. Get A Free Information Kit. For Homeowners Age 61.

Web The answer is simple. The requirement for cash reserves varies depending on the purpose of your loan the type of property youre financing your. Web What Are Reserve Requirements.

Reserve requirements are the amount of cash that banks must have in their vaults or at the closest Federal Reserve bank in. Web When are mortgage reserves needed. For Homeowners Age 61.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web If a lender is processing multiple second home or investment property applications simultaneously the same assets may be used to satisfy the reserve. If your monthly housing cost is 1500 then you would need 3000.

Get A Free Information Kit. Lenders often require documentation for proof of income and funds to cover your down payment closing costs and cash reserves. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Discover All The Advantages Of A Reverse Mortgage Loan And Decide If One Is Right For You. If you borrow 2 million for example youre viewed by a lender as riskier than someone who. Web Some conventional mortgages allow down payments as low as 3 but to qualify youd likely need to meet stricter credit score and debt-to-income ratio.

Mortgage reserves are one month of your total mortgage payment. Web If a lender says you need two months of reserves to buy a home you must have 2000. Web The requirements for a reverse mortgage specify a certain eligible age group 62 and over and property standards outlined by the US Department of Housing.

Tm2011676d3 Ex1img042 Jpg

Mortgage Reserve Requirements When Buying A Home

What Are Mortgage Reserves Learn About Cash Reserve Requirements After Closing On Your Home Loan

Asset And Reserves Requirements And Guidelines For Mortgages

What Are Reserves In Mortgage Everything You Need To Know

90 Day Game Plan To Homeownership

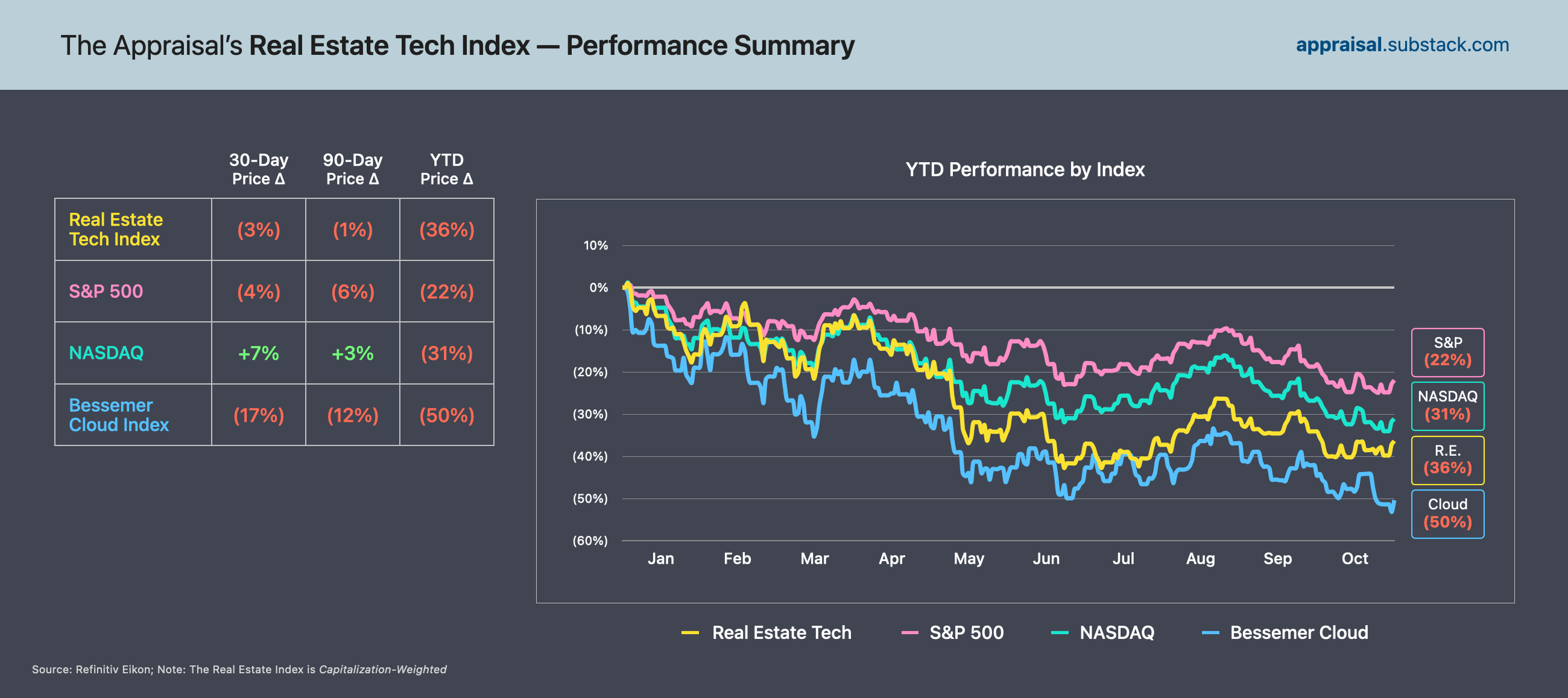

The Appraisal October 2022 Real Estate Tech Market Map Multiples Update

Wfc2022

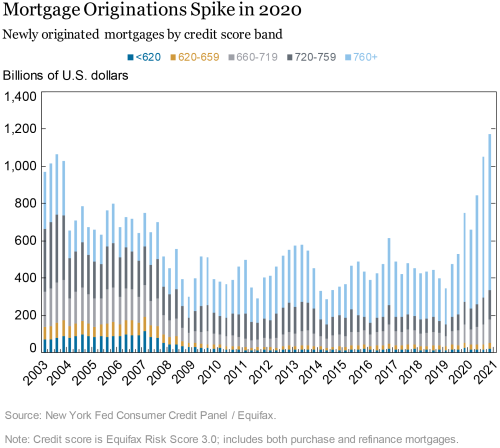

Mortgage Rates Decline And Prime Households Take Advantage Liberty Street Economics

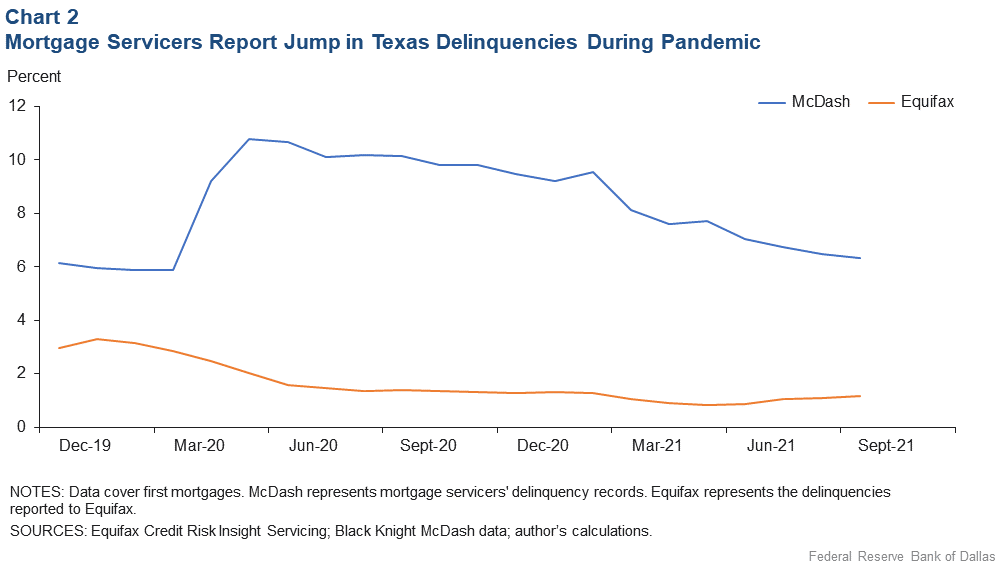

Pandemic Mortgage Relief Headed Off Delinquencies But What Happens Now Dallasfed Org

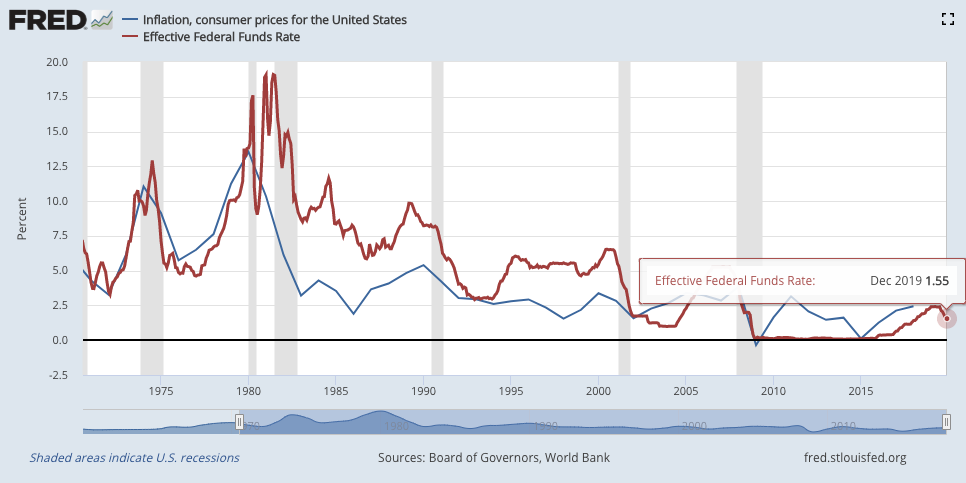

Treasury Market Had A Cow Mortgage Rates Jumped Wall Street Crybabies Clamored For Help But The Fed Smiled Satisfied Upon Its Creation Wolf Street

How Mortgage Rates Move When The Federal Reserve Meets Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Are Mortgage Reserves Learn About Cash Reserve Requirements After Closing On Your Home Loan

Down Payment And Closing Costs Are Not Enough You Need Reserves To Buy A Home Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Drop In 10 Year Treasury Yield Mortgage Rates Is Just Another Bear Market Rally Longer Uptrend In Yields Is Intact With Higher Highs And Higher Lows Wolf Street

What Are Mortgage Reserves Learn About Cash Reserve Requirements After Closing On Your Home Loan

6wifidghpi0lwm